Corporate Governance

- Overview of corporate governance

- Overview of Audit system

- Overview of directors and officers

- Executive compensation

- Shareholding status

Overview of corporate governance

Basic approach

At Furuya Metal, we focus on platinum group metals (PGMs)—including platinum, iridium (Ir), palladium (Pd), rhodium (Rh), and ruthenium (Ru)—and apply our specialized expertise to realize our corporate philosophy of “contributing to the advancement of science and technology and the prosperity of society.”

To fulfill our responsibilities to shareholders, employees, business partners, and other stakeholders, we are committed to conducting our business with integrity and accountability.

Our fundamental management policy emphasizes a strong commitment to compliance and the cultivation of employees with strong moral character and a clear vision, as well as the pursuit of sound management that earns the trust of customers and shareholders.

To realize these principles, we have established the Furuya Metal Code of Conduct for Officers and Employees and recognize the enhancement of corporate governance as a key management priority. We are continuously working to maintain and strengthen our corporate governance framework to ensure transparency, soundness, and strict compliance with applicable laws and regulations.

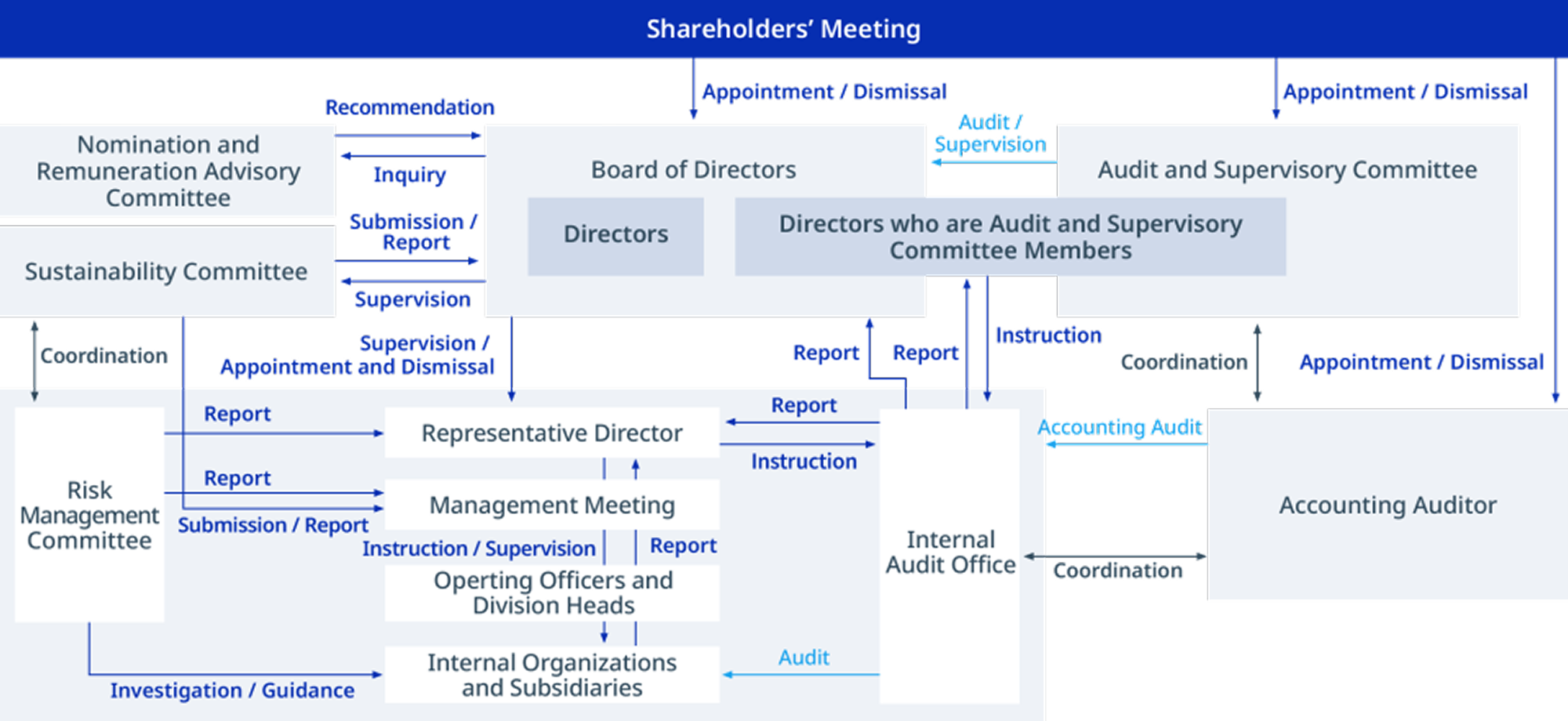

Corporate governance structure

Overview of the governance framework

To enhance the supervisory function of the Board of Directors and further strengthen corporate governance, the Company transitioned from a company with an Audit and Supervisory Board to a company with an Audit and Supervisory Committee, following approval at the 53rd Ordinary General Meeting of Shareholders held on September 28, 2021.

The establishment of the Audit and Supervisory Committee has strengthened the supervisory function of the Board of Directors and further enhanced our overall governance system.

The Board of Directors consists of six directors (excluding those who are Audit and Supervisory Committee Members), including two outside directors, and three directors who are Audit and Supervisory Committee Members, including two outside directors.

Representative Director Takahito Furuya serves as Chairperson of the Board.

One outside director and two outside directors who serve as Audit and Supervisory Committee Members are designated as Independent Officers as defined by the Tokyo Stock Exchange.

The two outside directors serving as Audit and Supervisory Committee Members, who are also designated as Independent Officers, are considered by the Company to have no potential conflicts of interest with general shareholders.

Together with the other seven directors, they ensure appropriate deliberation and objective judgment in decision-making on important matters at Board meetings.

The Audit and Supervisory Committee comprises one internal director and two outside directors, conducting systematic audits and oversight through the Company’s internal control systems.

Outline and rationale of the governance structure

We believe that by adopting the following framework, we have secured sound business operations and enhanced management transparency.

To strengthen the decision-making and supervisory functions of the Board of Directors and to establish an efficient management and execution structure, the Company has determined that the company with an Audit and Supervisory Committee system is the most effective form of organizational design and has adopted this structure accordingly.

Corporate governance framework

Development of internal control systems

Systems to ensure compliance by directors and employees

The Company has established regulations governing its compliance framework and has defined a code of conduct to ensure that all officers and employees act in accordance with laws and social norms.

To promote thorough compliance, the General Affairs and CSR Department oversees company-wide initiatives and provides education and training programs for officers and employees.

The Internal Audit Office, in cooperation with the General Affairs and CSR Department and the Human Resources Department, conducts audits of compliance activities.

The results of these activities are periodically reported to the Board of Directors and the Audit and Supervisory Committee.

In addition, a whistleblowing hotline system has been established and is operated both internally and through an external third-party organization to enable employees and other personnel to directly report any acts or behaviors that may be suspected of violating laws or regulations.

Systems to ensure efficient execution of duties by directors

The Board of Directors, in principle, meets once a month and on an ad hoc basis as necessary to deliberate and make decisions on important management matters of the Company, and to supervise overall business and management activities.

Important management matters of subsidiaries are also deliberated by the Company’s Board of Directors, which may request reports as necessary, thereby maintaining a framework to supervise subsidiaries.

In addition, the Management Meeting is, in principle, held once a month to discuss key matters related to business execution, ensuring appropriate and prompt decision-making by the Board of Directors.

Chairperson: President Takahito Furuya

Members: Director Tomohiro Maruko, Director Hideki Kuwabara, Director Tsutomu Nishimura, Outside Director kazunori Ochiai, Outside Director Hideki Wakabayashi, Director (Audit and Supervisory Committee Member) Kazuo Shimazaki, Outside Director (Audit and Supervisory Committee Member) Keiko Matsubayashi, Outside Director (Audit and Supervisory Committee Member) Michio Nakajin

Efforts to strengthen corporate governance

Evaluation of the effectiveness of the Board of Directors

To further enhance the effectiveness and functionality of the Board of Directors, the Company conducts an annual evaluation of the overall effectiveness of the Board, including that of the Nomination and Remuneration Advisory Committee.

The evaluation method, process, and summary of results for the fiscal year ended June 30, 2024, are as follows.

Process and evaluation method

For the evaluation of the effectiveness of the Board of Directors for the fiscal year ended June 30, 2024, a questionnaire survey was conducted among all eleven directors.

The issues and specific measures identified through the survey were discussed by the Board of Directors.

To ensure transparency and maintain anonymity, a third-party organization was engaged to tabulate and analyze the responses.

Evaluation process

・Evaluation period: Fiscal year 2023

・Questionnaire responses (anonymous): May 2024

・Aggregation and analysis of responses: June–July 2024

・Report and discussion at the Board of Directors meeting: September 2024

Content and evaluation items

Evaluation items

・Evaluation items included the

・Role and function of the Board of Directors

・Size and composition of the Board

・Operation of the Board of Directors

・Coordination with audit bodies

・Relationship with outside directors

・Relationship with shareholders and investors

・Effectiveness of the Nomination and Remuneration Advisory Committee

Summary (strengths)

Based on the analysis and deliberation of the questionnaire results, it was confirmed that the effectiveness of the Company’s Board of Directors has been appropriately ensured. In particular, the following points were highly evaluated and recognized as strengths of the Company’s Board of Directors:

・A well-balanced and diverse composition of the Board in terms of skills and experience.

・Appropriate scheduling and frequency of board meetings with smooth and efficient operations.

・Effective coordination with audit bodies were highly evaluated.

Issues and future policy

To further enhance the Board’s effectiveness, the Company has identified areas for improvement:

・Further expansion of discussions on medium- to long-term management strategies

・Review of reporting items submitted to the Board of Directors

・Enhancement of investor and shareholder relations activities

The Company will continue efforts to further enhance the effectiveness of the Board of Directors.

Matters concerning employees who assist the duties of the Audit and Supervisory Committee and the effectiveness of instructions to such employees

The Audit and Supervisory Committee has established the Audit and Supervisory Committee Office to support the execution of its duties.

Employees assigned to the Audit and Supervisory Committee Office provide support to the Committee under its direction.

These employees are obligated to maintain confidentiality regarding any instructions or information received from the Audit and Supervisory Committee or its members.

Matters concerning the independence of employees who assist the duties of the Audit and Supervisory Committee

With respect to personnel matters such as recruitment, transfers, and performance evaluations of employees assigned to the Audit and Supervisory Committee Office, prior consultation is held with the Audit and Supervisory Committee (or with a specific committee member designated by the Committee, if applicable).

Directors and employees also take due care to ensure that the independence of these employees is maintained.

Systems for reporting to the Audit and Supervisory Committee

The Company has established a system to ensure that directors and employees promptly report to the Audit and Supervisory Committee not only matters required by law, but also any issues that could have a significant impact on the Company, the status of internal audits, and reports received through the Compliance Hotline, including their details.

The specific methods of reporting—such as the reporting parties, recipients, and timing—are determined through consultation between the directors and the Audit and Supervisory Committee. Furthermore, no individual who makes such a report shall be subject to any unfavorable treatment.

Systems to ensure the appropriateness of operations of subsidiaries

The Company’s directors have established a compliance framework and regularly receive reports on the operational and financial status of subsidiaries.

The Internal Audit Office also conducts audits of subsidiaries, and the results are reported to the Representative Director and the heads of relevant departments. Through these measures, the Company ensures the appropriateness and soundness of subsidiary operations.

Development of the risk management system

To promote sustainable growth through a sound and resilient corporate governance system, risk management, compliance, human resource foundation, and governance structure, the Company has established the Sustainability Committee, chaired by the President.

The matters discussed and activity reports of the Committee are regularly submitted to the Management Meeting and the Board of Directors.

In addition, in relation to crisis management across the Company and its subsidiaries, we recognize risks in business operations, finance, compliance with laws and regulations, labor management, disasters, and the environment as potential sources of physical, economic, or reputational harm.

To appropriately identify and manage these risks and opportunities, the Risk Management Committee, composed primarily of directors, oversees and coordinates related measures.

Summary of liability limitation agreements

The Company has entered into agreements with its directors (excluding those who are executive directors, etc.) to limit their liability for damages under Article 423, Paragraph 1 of the Companies Act, provided that the requirements stipulated by laws and regulations are met. The maximum amount of liability for damages under such agreements is set at the higher of five million yen (¥5,000,000) or the minimum liability amount prescribed by law.

Summary of directors and officers liability insurance policy

The Company has entered into a directors and officers (D&O) liability insurance policy with an insurance company pursuant to Article 430-3, Paragraph 1 of the Companies Act.

Under this policy, damages such as compensation for losses and litigation expenses are covered in cases where an insured person becomes subject to a claim for damages arising from the execution of their duties.

The scope of insured persons includes the Company’s directors (including directors who are Audit and Supervisory Committee Members) and operating officers.

All insurance premiums are borne entirely by the Company.

Requirements for special resolutions at the General Meeting of Shareholders

The Company’s Articles of Incorporation stipulate that, with respect to special resolutions at the General Meeting of Shareholders as set forth in Article 309, Paragraph 2 of the Companies Act, such resolutions shall be adopted by shareholders representing not less than one-third of the voting rights of all shareholders entitled to exercise their voting rights, and by a majority of not less than two-thirds of the voting rights of those present.

This provision is designed to facilitate the smooth operation of the General Meeting of Shareholders by easing the quorum requirements for special resolutions.

Number of Directors

The Articles of Incorporation stipulate that the number of directors (excluding those who are Audit and Supervisory Committee Members) shall be limited to twelve (12), and that of directors who are Audit and Supervisory Committee Members to five (5).

Election of Directors

Directors are elected at the General Meeting of Shareholders, with a distinction made between those who are Audit and Supervisory Committee Members and those who are not.

Resolutions for such elections shall be adopted at a meeting attended by shareholders representing not less than one-third of the total voting rights of all shareholders entitled to exercise such rights, and approved by a majority of the voting rights of those present.

The Articles of Incorporation stipulate that cumulative voting shall not be used in the election of Directors.

Matters Resolved by the Board of Directors That Would Otherwise Require a Resolution of the General Meeting of Shareholders, and the Reasons Therefor

The Articles of Incorporation stipulate that, by resolution of the Board of Directors, the Company may distribute dividends of surplus pursuant to Article 454, Paragraph 5 of the Companies Act to shareholders or registered pledgees of shares who are listed or recorded in the register of shareholders as of December 31 or June 30 of each year.

This provision is designed to allow the Company to return profits to shareholders promptly and flexibly.

Activities of the Board of Directors

During the fiscal year under review, the Company held 16 meetings of the Board of Directors.

The attendance record of each director is as follows.

| Title | Name | Attendance |

|---|---|---|

| President | Takahito Furuya | 15/16(94%) |

| Director | Tomohiro Maruko | 16/16(100%) |

| Director | Hiroyuki Sakakida | 16/16(100%) |

| Director | Hideki Kuwabara | 15/16(94%) |

| Director | Tsutomu Nishimura | 13/13(100%) |

| Outside Director | Shoetsu Abe | 16/16(100%) |

| Outside Director | Shigeyuki Hiroki | 16/16(100%) |

| Director and Full-time Audit and Supervisory Committee Member | Kazuo Shimazaki | 16/16(100%) |

| Outside Director (Audit and Supervisory Committee Member) | Hiroe Fukushima | 16/16(100%) |

| Outside Director (Audit and Supervisory Committee Member) | Keiko Matsubayashi | 16/16(100%) |

Note:

With respect to Director Tsutomu Nishimura, attendance is based only on meetings of the Board of Directors held after his appointment on September 26, 2024.

The main matters deliberated and resolved by the Board of Directors during the fiscal year under review included confirmation of progress on key initiatives under the Medium-Term Management Plan “KFK Vision 2030,” the annual budget, funding policies, major personnel matters, quarterly financial results, business strategy investments, and sustainability-related agenda items.

In addition to these deliberations, reports on the execution of operations were also presented by each business division.

Activities of the Nomination and Remuneration Advisory Committee

During the fiscal year under review, the Company held three (3) meetings of the Nomination and Remuneration Advisory Committee.

The attendance record of each committee member is as follows.

| Title | Name | Attendance |

|---|---|---|

| President | Takahito Furuya | 2/2(100%) |

| Outside Director (Audit and Supervisory Committee Member) | Hiroe Fukushima | 2/2(100%) |

| Outside Director (Audit and Supervisory Committee Member) | Keiko Matsubayashi | 2/2(100%) |

The main matters deliberated by the Committee during the fiscal year under review were as follows:

・Selection of the Representative Director

・Election of Directors (excluding those who are Audit and Supervisory Committee Members)

・Determination of individual remuneration for Directors (excluding Audit and Supervisory Committee Members)

・Determination of individual performance-linked remuneration for Directors (excluding Audit and Supervisory Committee Members)

Overview of directors and officers

Appointment of directors

For internal directors, the Company appoints individuals with extensive knowledge, experience, and capabilities from among the senior management of its key divisions.

Outside directors are appointed in accordance with selection criteria, choosing individuals who possess the expertise, knowledge, and experience expected by the Company from among those with broad experience and qualifications in leadership positions across key organizations.

In appointing directors, the Company also considers diversity in terms of gender, international experience, and other attributes, with the goal of maintaining an appropriately balanced composition of the Board of Directors.

Coordination among outside directors’ supervision and audits, internal audits, audits by the Audit and Supervisory Committee, accounting audits, and their relationship with the internal control division

The roles and functions performed by outside directors in corporate governance are as described in the section titled “Corporate governance structure.”

Outside directors (who are Audit and Supervisory Committee Members), the Internal Audit Office, and the accounting auditor regularly, or as needed, share information to strengthen management oversight and enhance the effectiveness of audits.

Through audit reports and quarterly reviews, the Company ensures that the external accounting auditor has regular opportunities to exchange information with the Audit and Supervisory Committee.

In addition, the Company provides opportunities for coordination between the external accounting auditor and both the Internal Audit Office and outside directors, as requested by the external auditor.

Audit status

Status of audits by the Audit and Supervisory Committee

Organization, personnel, and procedures of the Audit and Supervisory Committee

The Company’s Audit and Supervisory Committee consists of three Directors, including two Outside Directors.

All Directors who serve as Audit and Supervisory Committee Members attend meetings of the Board of Directors.

In addition, the full-time Director who serve as an Audit and Supervisory Committee Member attends important meetings such as the Management Meeting, monitors and supervises the Company’s management by receiving reports from other Directors regarding the status of business execution and by expressing opinions when necessary, and shares relevant information with the Outside Directors.

Activities of the Audit and Supervisory Committee

During the fiscal year under review, the Company held 15 meetings of the Audit and Supervisory Committee.

The attendance record of each committee member is as follows.

Audit and Supervisory Committee Member (Full-time) Kazuo Shimazaki 15 / 15 (100%)

Audit and Supervisory Committee Member (Outside) Hiroe Fukushima 15 / 15 (100%)

Audit and Supervisory Committee Member (Outside) Keiko Matsubayashi 15 / 15 (100%)

The main matters deliberated by the Audit and Supervisory Committee included the audit policy and audit implementation plan, the status of development and operation of the internal control system, the appropriateness of the methods and results of audits conducted by the accounting auditor, consent to audit remuneration, and sustainability-related matters.

The activities of the full-time Audit and Supervisory Committee Member included:

・Communication with directors and other officers

・Attendance at meetings of the Board of Directors and other important meetings

・Review of key approval documents

・Inspections of operations and assets at the head office, factories, and major business sites

・Participation in meetings of the Internal Audit Office

・Attendance at management meetings of subsidiaries

・Confirmation of reports from the accounting auditor regarding audit implementation and results

The details and findings from these activities were appropriately shared with the outside directors.

Status of internal audits

Organization, personnel, and procedures of internal audits

The company has established the Internal Audit Office, which reports directly to the President, and is staffed by two dedicated full-time members.

In accordance with the Internal Audit Regulations, the Internal Audit Office conducts internal audits in a systematic and planned manner each fiscal year.

Coordination among internal audits, audits by the Audit and Supervisory Committee, and accounting audits, and the relationship between these audits and the internal control department

The Audit and Supervisory Committee and the Internal Audit Office cooperate closely in auditing each department by discussing audit plans, sharing audit items, and exchanging information to enhance and improve the efficiency of audits.

The Internal Audit Office is also responsible for the establishment, assessment, and promotion of internal controls.

The results of these activities are reported to the full-time Audit and Supervisory Committee Member, with whom discussions are held to strengthen and advance the internal control system.

Furthermore, the Internal Audit Office exchanges opinions with the Audit and Supervisory Committee, as necessary, regarding the status of internal control audits and risk assessments conducted by the Accounting Auditor, thereby maintaining close coordination among all audit functions.

Efforts to ensure the effectiveness of internal audits

The Internal Audit Office reports the results of internal audits conducted in accordance with the internal audit plan to the President and Representative Director on a monthly basis.

In addition, monthly reports are submitted to the Management Meeting and the Board of Directors.

Status of accounting audits

Name of auditing firm

Taiyo LLC

Continuous audit period

26 years since the fiscal year ended June 2000

Certified public accountants who executed audit duties

・Tomohiko Shinoda (6 consecutive years including the current fiscal year)

・Shintaro Eguchi (1 consecutive years including the current fiscal year)

Composition of assistants involved in audit work

Assistants involved in the Company’s accounting audits consisted of 4 certified public accountants and 12 other staff members.

Policy and reasons for selecting the auditing firm

The Audit and Supervisory Committee evaluates and selects the Accounting Auditor based on the Practical Guidelines for Audit and Supervisory Board Members Regarding the Formulation of Evaluation and Selection Standards for Accounting Auditors published by the Japan Audit and Supervisory Board Members Association.

In making this assessment, the Committee confirms that the auditing firm maintains:

・a robust quality control system,

・independence and professional competence,

・an appropriately structured audit framework,

・and reasonable and appropriate audit plans and fees.

The committee conducts a comprehensive evaluation based on audit performance and other relevant factors and makes a determination on the selection of the Accounting Auditor.

If there is any obstacle to the execution of duties by the Accounting Auditor or if deemed necessary, the Committee determines the contents of proposals to be submitted to the General Meeting of Shareholders for the dismissal or non-reappointment of the Accounting Auditor.

Administrative action against the auditing firm

Taiyo LLC was subject to administrative action by the Financial Services Agency (FSA) on December 26, 2023, as outlined below.

(i) Subject of the action

Taiyo LLC

(ii) Details of the action

Suspension of operations related to the conclusion of new contracts for three months (from January 1, 2024, to March 31, 2024).

Note: This does not apply to the renewal of existing audit contracts or to new contracts concluded in connection with newly listed companies.

Business improvement order (enhancement of business management systems).

Prohibition for three months (January 1, 2024 – March 31, 2024) of involvement in part of the audit work (audit review) by employees who were substantially responsible for the acts leading to the administrative action.

(iii) Reason for the action

Two certified public accountants employed by Taiyo LLC failed to exercise due professional care in auditing correction reports for other companies and issued audit opinions that incorrectly certified financial statements containing material misstatements as being free from such misstatements.

The Audit and Supervisory Committee received explanations from Taiyo LLC regarding the details of the administrative action and the outline of its business improvement plan.

As a result, the Audit and Supervisory Committee confirmed that the administrative action does not directly affect the Company’s audit, that steady progress has been made in implementing the business improvement plan, and that the Company’s audit work continues to be conducted appropriately.

Accordingly, the Committee resolved to appoint Taiyo LLC as the Company’s Accounting Auditor.

Evaluation of the accounting auditor by the Audit and Supervisory Committee

The Audit and Supervisory Committee receives reports from the Accounting Auditor regarding the status of the execution of its duties and, in addition to confirming the appropriateness of the criteria set forth in the selection policy described above, evaluates the auditor from the perspectives of:

・the adequacy of communication with management, the Audit and Supervisory Committee, the accounting department, and the Internal Audit Office;

・the effectiveness of audits of the entire corporate group; and

・the auditor’s response to fraud risk.

As a result of this evaluation, the Committee has determined that Taiyo LLC is qualified to serve as the Accounting Auditor of the Company.

Details of audit remuneration and related matters

Remuneration to certified public accountants and others

| Category | Previous consolidated fiscal year (¥ million) | Current consolidated fiscal year (¥ million) | ||

|---|---|---|---|---|

| Remuneration based on audit attestation services | Remuneration based on non-audit services | Remuneration based on audit attestation services | Remuneration based on non-audit services | |

| Total (Parent company) | 33 | 1 | 31 | - |

| Total (Consolidated subsidiaries) | - | - | - | - |

| Grand total | 33 | 1 | 31 | - |

Contents of non-audit services provided to the certified public accountants

The non-audit services provided consist of the preparation of a comfort letter related to the issuance of new shares.

Policy for determining audit remuneration

The policy for determining audit remuneration payable to the Company’s certified public accountants and other personnel considers factors such as the Company’s scale, business activities, and the number of audit days. The remuneration is determined through discussions with the Accounting Auditor and is subject to the consent of the Audit and Supervisory Committee.

Reason for the Audit and Supervisory Committee’s consent to the remuneration of the auditing firm

Based on the Practical Guidelines for Audit and Supervisory Board Members Regarding the Formulation of Evaluation and Selection Standards for Accounting Auditors published by the Japan Audit and Supervisory Board Members Association, the Audit and Supervisory Committee reviewed the audit plan reported by the auditing firm, as well as the appropriateness of past audit execution and the basis for estimating remuneration in previous consolidated fiscal years.

The Audit and Supervisory Committee gave its consent regarding the remuneration of the auditing firm pursuant to Article 399, Paragraph 1 of the Companies Act.

Remuneration of directors and officers

Total remuneration by officer category, total remuneration by type, and number of officers eligible

| Officer category | Total amount of remuneration (¥ million) | Total amount by type of remuneration (¥ million) | Number of officers covered (persons) | |||

|---|---|---|---|---|---|---|

| Fixed remuneration | Performance-linked remuneration | Restricted stock remuneration | Of which, non-monetary remuneration, etc. | |||

| Directors (excluding Audit and Supervisory Committee Members and Outside Directors) | 443 | 229 | 153 | 60 | 60 | 6 |

| Directors (Audit and Supervisory Committee Members, excluding Outside Directors) | 15 | 15 | - | - | - | 1 |

| Outside Directors | 27 | 26 | 1 | - | - | 3 |

Note:

Of the total amount of non-monetary remuneration, etc. paid to Directors (excluding Audit and Supervisory Committee Members and Outside Directors), ¥60 million represents restricted stock remuneration.

Total amount of remuneration, etc. for persons whose total remuneration exceeds ¥100 million

| Name | Officer category | Total amount of remuneration (¥ million) | Breakdown of remuneration by type (¥ million) | |||

|---|---|---|---|---|---|---|

| Fixed remuneration | Performance-linked remuneration | Restricted stock remuneration | Of which, non-monetary remuneration, etc. | |||

| Takahito Furuya | Director | 327 | 193 | 100 | 33 | 33 |

Note:

Of the total amount of non-monetary remuneration, etc. paid to Takahito Furuya, ¥33 million represents restricted stock remuneration.

Significant employee compensation paid to directors who concurrently serve as employees

| Total amount (¥ million) | Number of directors (persons) | Details |

|---|---|---|

| 56 | 5 | Salaries paid in their capacity as employees |

Policy on determining director’s remuneration

Matters concerning the policy on determining the amount or calculation method of remuneration for directors

With respect to directors’ remuneration for the fiscal year under review, at the 55th Ordinary General Meeting of Shareholders held on September 26, 2023, it was resolved to revise the maximum aggregate amount of remuneration for directors (excluding directors who serve as Audit and Supervisory Committee Members) to no more than 600 million yen per year, of which no more than 30 million yen per year shall be allotted to outside directors.

The amount of remuneration for directors (excluding those who concurrently serve as employees) excludes salaries paid to directors who concurrently serve as employees for their duties as employees.

As of the conclusion of the said General Meeting, there were six directors (excluding Audit and Supervisory Committee Members), including two outside directors.

For the fiscal year under review, the individual remuneration amounts for directors (excluding directors who are Audit and Supervisory Committee Members) were determined by a resolution of the Board of Directors held on September 26, 2024.

In determining such remuneration, the Board consulted the voluntary Nomination and Remuneration Advisory Committee, which is composed of a majority of independent outside directors, and finalized the decision based on the committee’s recommendation.

The outline of this policy is as follows.

Basic Policy

The remuneration system for directors (excluding directors who are Audit and Supervisory Committee Members; hereinafter the same) is designed to enhance corporate value in line with the vision set forth in the Medium-Term Management Plan, which aims to further advance the digital society and realize a green society.

Remuneration decisions are made by the Board of Directors based on the recommendation of the voluntary Nomination and Remuneration Advisory Committee, to which the Board makes a formal inquiry.

Specifically, the remuneration structure consists of:

・Fixed remuneration, determined according to position and responsibilities;

・Performance-based remuneration, provided as an incentive to drive annual performance toward corporate value creation; and

・Medium- to long-term performance-linked remuneration (restricted stock compensation), which aligns directors’ motivation and performance with sustained enhancement of corporate value.

The calculation of remuneration takes into account each director’s achievements, position, responsibilities, and performance, while for outside directors, duties and professional background are also considered.

The proposed amounts are submitted by the Board of Directors to the Nomination and Remuneration Advisory Committee for deliberation. Following the committee’s recommendation, the Board passes a resolution, confirming that the decision aligns with the established policy.

Policy on determining individual fixed remuneration (monetary compensation) for directors

In response to a request from the Board of Directors, the Nomination and Remuneration Advisory Committee deliberates on the appropriate remuneration levels and reviews and evaluates the individual fixed remuneration amounts for each director for the fiscal year, taking into account their respective positions and responsibilities.

Following its deliberation, the committee submits its recommendation to the Board of Directors, which determines each director’s individual fixed remuneration amount in accordance with the committee’s report.

Fixed remuneration is paid on a monthly basis.

Policy on determining performance-linked remuneration (monetary compensation) for directors

The performance indicators used to determine performance-linked remuneration are consolidated operating income, consolidated ordinary income, and profit attributable to owners of parent, as stipulated in the initial budget for the fiscal year.

For each director, the individual amount of performance-linked remuneration is calculated by applying a performance evaluation coefficient to a predetermined base amount corresponding to the scope of their responsibilities. The resulting remuneration is paid annually in cash at a fixed time each year.

Given that the Company’s business performance may be affected by market conditions, comparative evaluations with industry peers are also conducted.

Based on a mandate from the Board of Directors, the Nomination and Remuneration Advisory Committee reviews and evaluates the total amount and individual allocation of performance-linked remuneration by considering factors such as the year-on-year change and achievement ratio of the performance indicators for the fiscal year, as well as the progress of key individual initiatives set by each director at the beginning of the year.

Following deliberation, the committee submits its recommendation to the Board of Directors, which determines the total and individual amounts of performance-linked remuneration in accordance with the committee’s report.

Performance-linked remuneration is paid as a bonus after the conclusion of the Ordinary General Meeting of Shareholders.

Policy on determining non-monetary compensation for directors

As a form of non-monetary compensation, the Company grants restricted stock compensation to its directors.

The amount of such compensation is calculated based on a reference amount determined in accordance with the scope of each director’s responsibilities, and the individual allocation and timing of the grant are determined by a resolution of the Board of Directors.

Policy on determining the ratio of each type of remuneration for individual directors

Directors’ remuneration consists of fixed remuneration, performance-linked remuneration, and stock-based remuneration.

In accordance with the above basic policy, the Nomination and Remuneration Advisory Committee deliberates on the balance among these components to ensure that the overall structure effectively functions as an incentive for enhancing corporate value and shareholder value.

Policy on determining remuneration for directors who are Audit and Supervisory Committee members

The total amount of remuneration for directors who are Audit and Supervisory Committee members has been fixed at no more than 50 million yen per year, as resolved at the 53rd Ordinary General Meeting of Shareholders held on September 28, 2021.

The specific amount of remuneration for each Audit and Supervisory Committee member is determined through discussions among the committee members.

To ensure independence and objectivity, remuneration for directors who are Audit and Supervisory Committee members consists solely of fixed remuneration.

Status of shareholdings

Standards and approach for classifying investment securities

The Company has not established specific criteria for distinguishing between investment securities held for pure investment purposes and those held for purposes other than pure investment. However, the Company does not intend to hold shares for pure investment purposes.

Investment securities held for purposes other than pure investment

Number of issues and total book value recorded on the balance sheet for investment securities held for purposes other than pure investment

| Number of issues | Total book value (¥ million) | |

|---|---|---|

| Unlisted shares | 1 | 0 |

| Listed shares | 1 | 5 |

Classification, issuer name, number of shares, book value, and purpose of holding for investment securities held for purposes other than pure investment

| Issuer | Number of shares (current fiscal year) | Number of shares (previous fiscal year) | Purpose of holding / Overview of business relationship / Quantitative effect of holding / Reason for increase in shares | Whether the Company holds shares of the counterparty |

|---|---|---|---|---|

| Number of shares | Number of shares | |||

| Book value (¥ million) | Book value (¥ million) | |||

| Ohara Inc. | 5,400 | 5,400 | The shares are held to expand and develop mutual business operations through ongoing collaboration in areas such as sales, technology, and research and development with a business partner that primarily handles the sale of the Company’s products. | No. |

| 5 | 7 |

Deemed shareholdings

There are no applicable items.

Other non-applicable items

・The total book value of investment securities held for pure investment purposes in the previous and current fiscal years, as well as the total amount of dividends received, gains or losses on sales, and valuation gains or losses for the current fiscal year.

・The issuer names, number of shares, and book values of investment securities whose purpose of holding was changed from pure investment to purposes other than pure investment.

・The issuer names, number of shares, and book values of investment securities whose purpose of holding was changed from other than pure investment to pure investment.